Possibilities trade for starters

Posts

Deals with a volume of below one hundred a day might discover large spreads involving the bid plus the inquire costs. Once you happen to be happy to discuss the industry of possibilities change, you will need to look into the agents that you could discover an account. After you’ve selected a brokerage to utilize and you will done the newest membership software (normally, this is over online and is quite quick), you might request options trading approval.

To buy Phone calls (Much time Calls)

In return for it risk, a secure label approach provides restricted disadvantage defense in the setting of your own advanced acquired when offering the decision choice. Options traders need to earnestly display the price of the underlying investment to choose if they’re inside the-the-currency otherwise have to do it the possibility. To exercise a stock solution comes to to find (in the case of a call) or offering (in the case of an used) the root inventory from the its strike rates. This is frequently done just before termination whenever an alternative is deeply regarding the money which have a good delta near to 100, otherwise at the expiration if it is regarding the currency at any number. Whenever exercised, the option disappears plus the fundamental asset is introduced (a lot of time otherwise quick, respectively) from the struck speed. The fresh buyer can then like to close-out the position in the the root from the prevailing market prices, from the an income.

As to the reasons trading options?

Martina get $215 for every display (hit cost of the option) and certainly will secure the $2 hundred inside income in the premium, however, she misses from the enormous development on the stock. In case your share cost of Parker Markets drops in order to $190 just after 90 days, the consumer of one’s name choice will not do it they while the it’s ‘out of the money’. Within condition the value of Martina’s holdings within the offers out of Parker Marketplaces provides reduced, but which losses is actually offset because of the income regarding the superior of one’s call option one she ended up selling. The brand new show cost of Virtucon does fall-in rates sure enough, along with 90 days offers is actually trade to have $fifty.

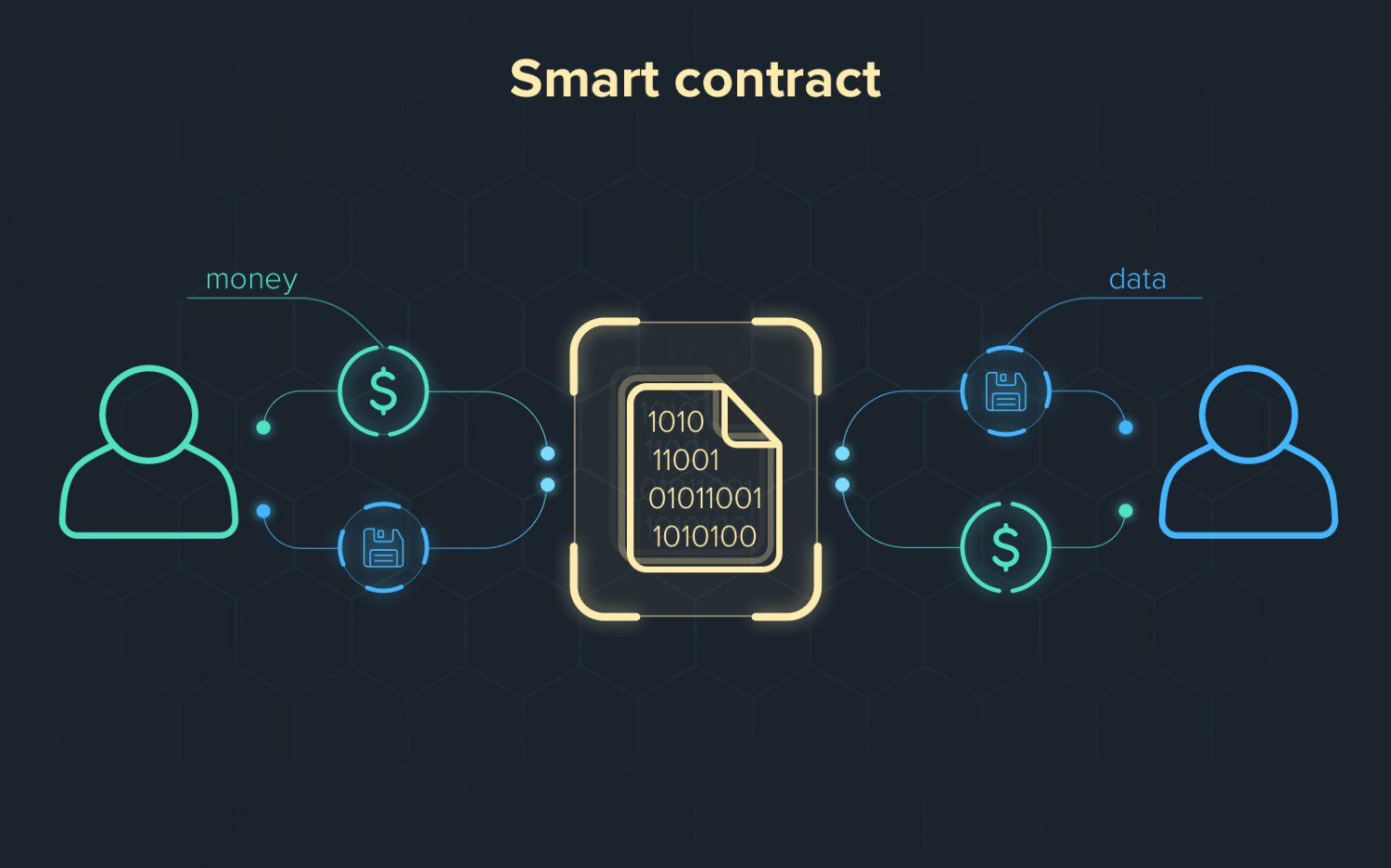

Money and you may larger situations will likely be catalysts to have significant inventory rate alter. When you attend exchange alternatives, there are a table of contracts the considering termination time. We have found the main table to have https://bytesproject.com/ Apple (AAPL 0.05%) call alternatives expiring in the August 2023 whenever offers traded at around $177. An alternative are a binding agreement between a few functions that delivers the brand new package proprietor the right, however the duty, to buy or promote offers away from an inventory during the a specified rates to the or ahead of a selected day. Maximum loss is restricted for the width of your own give without the premium gathered. The length between your strikes of your small label/place and also the enough time name/place is $5 for every share (or $five-hundred per bargain).

It integrates an extended put that have having the root inventory, “marrying” both. This plan allows an investor to keep owning an inventory to own possible love when you are hedging the career should your inventory drops. It truly does work much like to shop for insurance policies, having a proprietor investing a premium to possess protection facing a decrease from the asset. If your stock stays at the or increases over the strike rates, owner takes the entire superior. In case your inventory sits underneath the strike speed in the conclusion, the newest put merchant is forced to buy the stock at the struck, realizing a loss of profits.

Simultaneously, if it exact same individual currently features connection with you to exact same company and you will would like to remove you to definitely visibility, they could hedge their exposure by the offering set options up against you to definitely organization. For many who workout your stock options, attempt to pay fees for the any profit which you generate. How their taxes is actually calculated utilizes the type of alternative you’ve got as well as how enough time your waiting anywhere between workouts your decision and offering the shares. Since it has shares of inventory (or an inventory list) as the hidden resource, stock options try a kind of equity by-product and may also become called collateral possibilities.

What is actually Alternatives Exchange? Ideas on how to Change Possibilities

The fresh trader next acquisitions a call option having a $50 struck rates, the speed your stock must surpass to the individual and make a profit. Fast-forward to the brand new conclusion date, where today, stock A posses increased to $70. That it call solution is really worth $20, since the stock An excellent’s price is $20 higher than the new struck cost of $fifty. In comparison, a trader manage profit from an used choice if your fundamental inventory were to slip less than their struck rate from the termination go out. Fundamentally, a stock choice allows a trader in order to bet on an upswing otherwise slide from confirmed inventory because of the a specific day inside the the long term. Often, large companies have a tendency to get commodity to hedge exposure experience of a given security.

After you’re ready to initiate possibilities change, initiate brief—you can always are much more aggressive options procedures later on. At first, it’s best to focus on a secured item you understand well and you can bet an expense your’re also comfy shedding. Alternatives change doesn’t seem sensible for everyone—especially individuals who choose a hands-of investing method. There are generally about three choices you have to make that have options exchange (direction, rates and you may time), and that contributes more complexity to the investing process than just many people favor. Agent standards may vary from zero for some thousand dollars. But not, trade an option account with just a hundred or so cash is maybe not prudent.